Acceleration, not Revolution

Mostly Covid-a9 is just pushing harder on existing migration patterns

In How the Pandemic Did, and Didn’t, Change Where Americans Move, Jed Kolko, Emily Badger and Quoctrung Bui unsnarl what we know about Covid migration patterns.

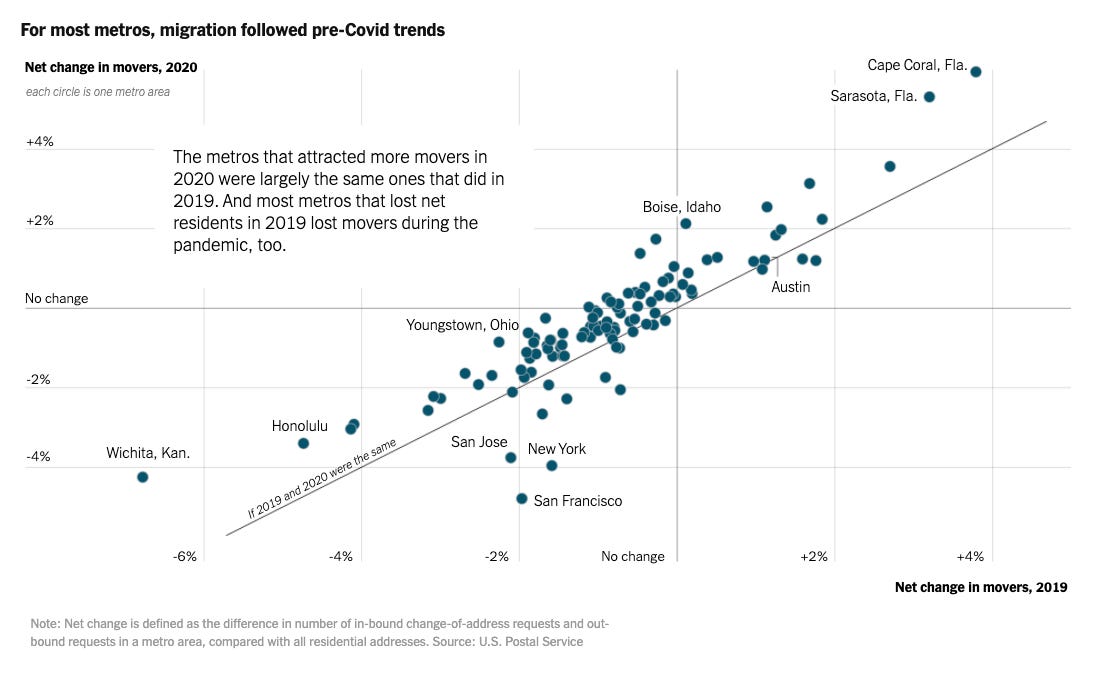

Mostly, it’s just a continuation of migration patterns from the beforetime.

The larger pattern among metros following the diagonal line above has been the stability of pre-pandemic trends. Sun Be…