Short Takes #5: The Best Test of Truth

Oliver Wendell Holmes Jr | All-Time Low Life Evaluation | Utility Costs | China Shock 1.0 and 2.0

When men have realized that time has upset many fighting faiths, they may come to believe even more than they believe the very foundations of their own conduct that the ultimate good desired is better reached by free trade in ideas – that the best test of truth is the power of the thought to get itself accepted in the competition of the market, and that truth is the only ground upon which their wishes safely can be carried out. That, at any rate, is the theory of our Constitution. It is an experiment, as all life is an experiment.

| Oliver Wendell Holmes Jr., Dissent in Abrams v United States (1919)

workfutures.io is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

All-Time Low Wellbeing

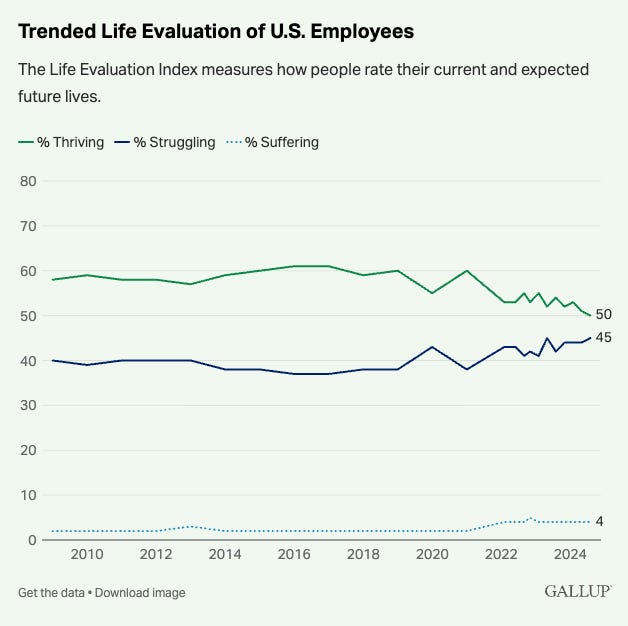

Uh-oh. Maybe I shouldn’t be surprised: Gallup reports 49% of U.S. employees are struggling or suffering, although they say it the other way around [emphasis mine]:

Fifty percent of U.S. employees are thriving in their overall lives, according to Gallup’s latest updated workplace wellbeing indicator. This marks a new record low since Gallup began measuring employee wellbeing in 2009. The rate of employees who were thriving peaked at 61% in both 2016 and 2017 but began declining in 2020. A brief rebound occurred in January 2021 as COVID-19 vaccinations became available and hopes of loosened restrictions grew. However, the downward trend continued.

My sense is that post-2024 swings in corporate attitudes — like the RTO push in tech, finance, and other knowledge-intensive fields, and growing layoffs — are taking their toll.

Utility Costs

Or maybe people are being pinched financially, leading to decreased wellbeing.

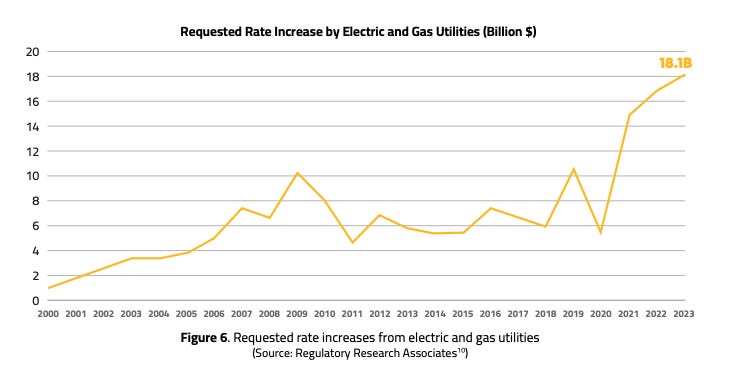

The States Forum reports on utility prices spiking [emphasis mine]:

U.S. residential electricity costs have risen by almost 30 percent since 2021, and residential gas costs have increased by 40 percent since 2019, significantly outpacing inflation. Today, nearly 80 million Americans are struggling to pay their utility bills, forgoing or falling behind on basic needs like food, education, and health care to keep their lights on.

According to PowerLines, this massive growth in utility rates is not principally an increase in generation costs [emphasis mine]:

The predominant driver of recent utility bill increases has been rising transmission and distribution costs, rather than generation costs. Ballooning distribution system expenses have placed particular upward pressure on utility bills. In 2023, distribution-related costs accounted for 44% of all utility capital expenditures and 35% of all utility costs including capital expenditures and operations and maintenance. These distribution capital expenditures have increased by more than 50% since 2019, more than double the pace of inflation; meanwhile, generation capital investments have decreased during that time frame.1

Electricity and gas rates are set by regulatory agencies in each state, and the utility companies are asking — and getting — huge rate increases approved.

The states are going to have to step in, and compel utilities to slow their expansionary plans, because the entire country is being squeezed.

China Shock 1.0 and 2.0

Dean Baker looks back to 1999, Bill Clinton’s (and Larry Summers’) enduring legacy is the hollowing out of US manufacturing following China joining the World Trade Organization [emphasis mine]:

China’s admission to the WTO, along with the high dollar policy pushed by the Clinton Treasury Department, led to a massive loss of manufacturing jobs over the next decade. In the 10 years from December 1999 to December 2009, we lost 5.8 million manufacturing jobs, more than one-third of the country’s total. These job losses devastated whole communities, where one or two factories were the major employers. Many have not recovered even today.

Someone made a lot of money outsourcing manufacturing to China, and millions of Chinese peasants were raised out of poverty, but working class Americans in those manufacturing centers were crushed.

I wrote about Janesville WI in 2017, and what happened when manufacturing cratered there in 2008:

The next China shock is in motion, and it’s likely to be worse, according to David Autor and Gordon Hanson, who detail China’s rise in competitive technology areas since 2015, and argue strenuously that tariffs are not the answer:

Managing China Shock 2.0 requires playing to our strengths, not licking our wounds. We must nourish industries that have high potential for innovation, funded by joint investments by the private and public sectors. These industries are in play globally, something China figured out a decade ago. We should stop fighting the last trade war and meet China’s challenge in the current one.

Otherwise, it won’t just be the loss of manufacturing jobs, but falling behind in everything.

Lawrence Berkeley National Laboratory, Retail Electricity Price and Cost Trends: 2024 Update.